Podcast

Learn from Fast Growing 7-8 Figure Online Retailers and eCommerce Experts

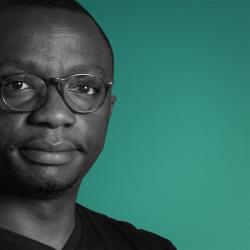

How to Monitor Your Competitors’ Prices with Prisync’s Burc Tanir

For many e-commerce retailers in a crowded market, price monitoring can become an issue. How do you monitor and keeping track of prices and price changes for a multitude of products across a multitude of competitors? And what actionable pricing strategies should you even have in place?

My guest on today’s episode, Burc Tanir, is here to help. Burc is a co-founder of Prisync, a SaaS-based price tracking platform that tracks your competitors’ prices, price changes, and even their stocks.

We start off talking about the origins of Prisync arising out of a market need for a price monitoring automation tool. Burc explains what types of e-tailers Prisync is most suited for and we then go through its special API features that provide valuable insights into your competitive environment. We then discuss pricing strategies to increase your profit margins based on these insights and even how suppliers can use price monitoring. Finally, Burc let’s us in on a trending sales strategy for 2016 which he is seeing that has it’s focus on customer retention. If you are looking to gain the competitive edge in a competitive market segment, this episode is not to be missed!

Key Points in Monitoring Your Competitors’ Prices Successfully

The major issue is that e-commerce companies are often acting in a terribly crowded market, so you definitely need an edge to sustain some competitive advantage.

1: Prisync Overview

How to check if a company would benefit from a competitor price tracker or not:

- Firstly, we work with online retailers. So it’s not for companies selling online tickets, online reservations, but it’s just for online retailers selling branded products.

- The basic check would be when you actually google one of your products and you end up with pages of google searches for that same product at different retailers. That means that you are competing in the market harshly and have many competitors selling the exact same product at different prices. If so, you are a potential client who would really benefit from our solution massively.

It’s a terribly crowded market, so you definitely need an edge to sustain some competitive advantage.

Price Comparison:

Think like a customer – so they google, or they use Google Shopping or other price comparison engines and when they search for products you basically end up just being one of the retailers supplying the product versus many other competitors.

- To give more concrete verticals we work with, we are quite active in consumer electronics, mom and baby, and also sports equipment or any e-commerce vertical with branded products. If there are suppliers supplying branded products to an e-commerce company, most probably they are supplying the exact same products to other retailers.

- Amazon is I think one of the best companies applying dynamic pricing within their operations and have sophisticated re-pricing algorithms. On average each Amazon product is changing prices once in 15 minutes, it’s actually a massive frequency. So of course, small or medium business companies cannot really directly compete with Amazon but what they can separate their competition as ‘Amazon’ and ‘Others’. So in most cases what we see is that companies are differentiating a single player like Amazon, Walmart or Ebay and their competitors. Then they mostly dynamically change their prices versus the other competitors. We do tell our clients that fighting with Amazon in prices is a definite loss because they have an amazing scale of supply at very low unit costs. However, companies also monitor and sometimes if they notice that Amazon is selling a product at a very high profit margin, they can also adjust their prices versus Amazon.

Seamless API

We have a quite seamless API which feeds all the data available in Prisync. So e-commerce companies can integrate our API with their own content management system no matter what the platform such as Magento and Shopify. So they can set their own re-pricing rules. And we are learning more and more about these re-pricing strategies so we will implement these also into our product in near future.

Full-featured and Seamless API:

- We have a quite seamless API which feeds all the data available in Prisync. So e-commerce companies can integrate our API with their own content management system no matter what the platform such as Magento and Shopify. So they can set their own re-pricing rules. And we are learning more and more about these re-pricing strategies so we will implement these also into our product in near future.

- Our API is full-featured so it contains any data that we already throughout Prisync. And those are basically the price points of any product at any website. So let’s say you’re tracking 100 products with 20 competitors. All the prices of those products get fed into our API four times a day at the moment, including their stock availability.

- But another important thing is access to historical data because you also need some big picture analysis at the end of the day. We provide historical data throughout Prisync, for example, last month’s prices or last weekend’s prices.

- We also have actually an index value, which is kind of an aggregated analysis for particular brands and categories. So while you can compare your product prices versus your competitors, you also need some indicators to work out how you should price a particular brand versus your competitors. And to do this we have an aggregation model which aggregates prices of particular brands and categories. We also deliver reports about their brand pricing performance or category pricing performance. This is also one of the features which really makes Prisych special in the eyes of our clients actually, and then they can also make further analysis on top of the raw data.

- All the data starts when uploaded for the first time in our system, but if we on-board a client who requires pricing information for particular products that we have been already monitoring, we supply them the retrospective data as well.

Email Alerts

they can get email alerts for any product they like, so they can either assign them as high priority or we can, again, group products in brands and categories. So our notifications become part of their e-commerce day-to-day operations. They go to the office for example at 9 and they sit down by their desk and at 9:15 we send them their email notifications.

2: Pricing and Sale Strategies

Unit Cost:

We have our own saying in the Prisync team that ‘Optimum price is not necessarily the lowest price’. Because at the end of the day we are all trying to build sustainable and profitable companies. So we also have another parameter in the game, which is the unit cost of the products. So you cannot for example discount your products infinitely because you have a threshold, which is your unit cost. We tell our clients to monitor their competitor prices along with unit costs and take actions according to their unit cost as well.

Two types strategic price moves from the data of Prisync:

- So the first case is where you are terribly low in price. For example, where you set a price for a product two months ago but since then your competitors have increased their prices due to some fluctuation in the market. So with Prisync you can notice that you’re too cheap and you can increase your price and actually save a lot of margin while still being the cheapest in the market. This is actually the strongest value proposition we deliver to our clients. Which is not really the expected thing, most people expect that we will force them to be the cheapest but mostly we help them to increase their prices in a smart way to make extra margins.

- The second is where you are dramatically expensive. So using Prisync they can also notice that their prices are logical at all and then decrease them versus competitors. We say that they should also consider unit costs and they should have a target margin in their minds, let’s say 5%, 10%, or whatever the strategy is. So they should adjust their prices versus competitors’ while always achieving their target margin. And thanks to that, we actually have an average of 7% profit margin increase achieved by our clients.

- We started as offering competitive price tracking service to just e-commerce retailers but now suppliers like Toshiba and Nike have gotten wind of and are also using Prisync. Tracking for suppliers for us is a new market shaping up that we are entering. So suppliers need to track their own branded product’s online prices to avoid minimum price violations. Suppliers have a brand image and that involves the prices of their products. So they to maintain prices that are in parallel with their brand positioning. However, in online retail you can see very deep discounts at a certain retailer at some point. So suppliers want to avoid that by monitoring online prices. But besides compliance tracking with Prisync, suppliers also do competitor tracking, for example, Toshiba monitors the average pricing of Lenovo laptops in the online retail market.

- I think we expect to see that in 2016 the e-commerce companies will focus on more on retention and less on costly acquisition. We’ve noticed some smart retailers building up a consistent discount strategy. So they for example have Special Saturdays or Special Mondays where they offer low prices on a group of products. This makes their already active consumers consume more from them. And so we expect to see more of these designed discount periods blended in parallel with the company strategy. Some of our clients have already started to apply that and they are using email marketing and they are kind of building a brand out of these discount days. And it’s really also receiving social interest, so people are sharing this day in Twitter and Facebook. It’s kind of a gamification of sales periods, I would say.

3: Parting Advice

3 Indispensible Tools:

- Slack: We communicate within our team with Slack.

- Assembla: We use Assembla as our ticketing platform.

- LinkedIn: I would also consider LinkedIn as a tool because it’s actually a crucial part of our marketing strategy.

Best Mistake:

Starting off with enterprise. We just started to knock on the doors of the big companies from day one and we noticed that they wanted something end-to-end. Then we re-focused on building something more compact, more self-service to tap the small and medium businesses. It changed the shape of the game actually.

One Piece of Advice:

Focus on your current customers. Focus on retention as much as you do for the acquisition. It will really create something.

Book Recommendation:

Effective Executive by Peter Drucker. It speaks about straightforward things in an actionable manner, which is the hardest part. If you always think of stuff but you don’t really take the action on them, this book helps you to take those actions.

Key Takeaways

(02:00) Introducing Burc Tanir

(08:28) Prisync Overview

(20:39) Pricing and Sale Strategies

(32:57) Parting Advice

Transcript

Hello guys, welcome to today’s episode. Now I have some one quite special because a few years ago I had a conversation with a quite established e-commerce retailer and wholesaler. They ran an e-commerce retail and wholesale business and one of the issues they were having, or you may even have, was tracking and monitoring competitor prices. So if you operate in quite a competitive e-commerce segment, you either monitor your competitors’ prices or you’re wondering how to monitor your competitors’ prices. My guest on today’s episode is Burc Tanir. He’s a cofounder of a company that does just that. The name of his company is called Prisync. It’s a SaaS-based price tracking platform that tracks competitor prices and stock levels in real-time. So I’m super excited to have him on the show. Without further ado, I’d like to welcome Burc to the show. Welcome, Burc.

Burc: Thank you, thank you. It’s great to be here with you, Kunle and many thanks for having us for this exciting conversation.

Kunle: Brilliant, brilliant, brilliant. Could you take a minute or two to introduce yourself and give our audience a bit of some background, you know, data on yourself and being the cofounder of Prisync, please.

Burc: Sure. So actually Prisync, you know, I have been involved with Prisync for the last two years, let’s say, but previously I was always interested in B2B and SaaS. So SaaS is really what we all are as Prisync team, so I was involved in many business development parts of different SaaS products. But two years ago, out of out very obvious needs, we came up with the idea of building a SaaS product which will be able to track competitor prices for e-commerce companies and since then we’re laser focused on a particular product called Prisync.

Kunle: Okay. Brilliance, brilliant. So you’ve been in the SaaS game or business for five years and Prisync is about two years old.

Burc: Kind of, yeah.

Kunle: Okay, cool. You have two other cofounders, from your LinkedIn profile I could see Samet and Selcuk, if I pronounce that one.

Burc: No, it’s Samet and Sirin are the…

Kunle: Sirin? Okay.

Burc: Yeah.

Kunle: It’s spelt SELCUK.

Burc: No, he’s not actually part of the company.

Kunle: Ah, okay.

Burc: We are currently three co-founders, so let me also give their names, so Samet and Sirin are the two other co-founders along with me on board at the moment. So we are like… I am mostly a handling the business development part and they are mostly involved with the product development part, but we are acting as three active co-founders at the moment.

Kunle: That’s amazing, that’s amazing, three cofounders. So you could push the business really, really far and strongly. So you’re based in Istanbul in Turkey.

Burc: Yes.

Kunle: Okay, and how was the idea arrived at? You said you’ve had a laser focus in last two years. How did you make that transition from the B2B space to e-commerce, which is largely B2B but in many other use cases it’s also B2B?

Burc: Yes. So actually the idea came up through friends I would say, it was quite interesting. So I had many close friends who were involved in e-commerce markets back two or three years ago and they were either entrepreneurs of their own companies or they were business developers in e-commerce companies based in the region, mostly in Istanbul. So whenever I had the chance to talk to them about their day-to-day operations, about the status of their companies, they were terribly complaining about the harsh price competition in the market. And after a while I noticed that one of their day-to-day operations was actually tracking their competitor prices by hand. So it became kind of standard task accepted within the company and that was actually terrible loss of smart manpower. And I noticed that and I talked to these guys and they said, ‘Well, we are trying to find an automated way but there are no such tools at the moment in hand.’ So when I just approached them with the idea of building such a product and to see whether they pay for that, they said, ‘We will definitely pay for it.’ [laughs] And from that point onwards you know I think we really felt an urge to build such a product which could be used in any size of e-commerce companies as a SaaS product. And since then, we have never been distracted from the idea of building it.

Kunle: Okay. That is really brilliant. So you’re a cloud-based SaaS price monitoring platform. How many customers do you currently manage and help?

Burc: So it’s now more than 100. And the nice thing is that our customers are coming from more than 30 countries spanning Europe, America, but also Asia and Middle East. So we are working with all size of e-commerce companies from all around the world. And yeah, it’s actually just started to take off during this summer because we had a different version previously and around summer we launched the version which was purely SaaS, so where companies could just visit our website, sign up, and add their products. So they could use the product fully SaaS service and since then we had a growth rate of about 20 – 25% month over month. So that’s the current business.

Kunle: That’s quite fascinating. The moment you moved to a SaaS based solution you started to get a growth rate of about 25%. Okay, right, so shall we talk about a typical use case. So for our listeners, I want to make this episode as useful to our listeners as possible. So for our listeners, most of our listeners are actual owners of e-commerce businesses or they are involved in the day to day management in some way, shape, or form of an e-commerce business. So from your perspective, from the 100 customers you have, or more, could you kindly provide a use case as to the needs for price monitoring?

Burc: Yep, sure. So the major issue here is actually to know that e-commerce companies are acting in a market with other 12 new players. So it’s a terribly crowded market, so you definitely need an edge to sustain some competitive advantage. And here we have a checklist to see whether a company would benefit from a competitor price tracker or not and it’s as simple as follows. So we first of all work with online retailers. So it’s not for companies selling online tickets, online reservations, but it’s just for online retailers selling branded products. So the basic check would be going to your own website and finding one of the products that you have in your featured carousel, let’s say it’s iPhone 5. When you google actually one of your products, when you end up with pages of google searches for that same product at different retailers, that means that you are competing in the market harshly. So that means that you have many competitors selling the exact same product at different prices. So when you suddenly notice that, you should also think like a customer because the customer actually does the same. So they particularly google, or they just use Google Shopping or other price comparison engines and they search for the products and you basically end up just being one of the retailers supplying the product versus many other competitors. So such companies are very, very potential clients and the ones who really benefit from our solution massively. So that’s basically our potential clients. And to give more concrete verticals, we are quite active in consumer electronics, mom and baby, and also sports equipment or any e-commerce vertical that you would imagine with branded products. So if there are suppliers supplying branded products to an e-commerce company, most probably they are supplying the exact same products to other retailers. So they are actually competing with each other. So that’s the potential market, potential list of clients we are working with, actually.

Kunle: Okay, okay. That’s a very brilliant answer because the branded product, that’s a core term here and I can imagine how competitive consumer electronics will be, it is a competitive space. It’s fast-moving and people know exactly what they’re looking for when it comes to electronics, be it a phone or television. So yeah, it’s quite interesting also from the perspective of the fact that if you don’t own your brand and you’re a merchandiser of other brands, you will definitely need to monitor other merchandisers of branded products, which will be in direct competition with yourself. So yeah, let’s talk about the big elephant in the room, Amazon. From the data that’s coming into Prisync how are retailers coping with Amazon? You know, when you compete on price with Amazon, it’s a race to the bottom in many cases. So how are you seeing, from the data you’re gathering? Any tactics? Are you seeing any tactics retailers are employing to acquire new customers with price monitoring, against Amazon especially?

Burc: Yeah, actually Amazon is I think one of the best companies applying dynamic pricing within their operations because they have their kind of own laboratory I would say which particularly focuses on this operation of tracking competitors and having sophisticated re-pricing algorithms. So actually we noticed that on average each Amazon product is changing prices once in 15 minutes. So it’s actually a massive frequency. So of course, small or medium business companies cannot handle that, so they cannot really directly compete with Amazon but what they can do is actually kind of separate their competition as ‘Amazon’ and ‘Others’. Because Amazon is massively dynamic but the others are actually another domain of competition. So in most cases what we see is that companies are really differentiating Amazon or a single player like Walmart or Ebay and their competitors. So they mostly dynamically change their prices versus the other competitors and they also monitor Amazon and they sometimes notice that Amazon is selling a product at a very high profit margin. So at that point they can also adjust their prices versus Amazon, but what we say to our clients is actually really fighting with Amazon in prices is a definite loss. So it’s really tough to maintain that because there is a amazing scale of supply so very low unit costs. So Amazon can really beat almost anyone if they fight in price.

Kunle: Okay. That makes a lot of sense. That makes massive load of sense because you need to find other areas to compete, perhaps on value or being a specialist, against Amazon. So if I’m selling maybe bicycles for instance, specialist road bikes for instance, because I have that expertise to set up a bike, to advise on the right frame to buy, I would always be better than Amazon customer service because they’re managing you know millions of other products.

Burc: Exactly.

Kunle: So I suppose that’s the only way you can compete, rather, in the present. I like the fact that you group Amazon with the really big ones like eBay and Walmart into one basket and then they then you know compare and re-adjust based on other competitors at a similar price. I just have another follow-up question. Do you have a re-pricing engine tied into Prisync?

Burc: Not natively but what we do is actually we have a quite seamless API which feeds all the data available in Prisync and e-commerce companies then can integrate our API with their own content management system no matter what the platform is. So it can be Magento, Shopify, or whatever platform they are using. They can seamlessly integrate with our API, so they can set their own re-pricing rules. But the thing is that we are learning more and more about these re-pricing strategies so we will implement these also into our product in near future.

Kunle: Okay .

Burc: So now… but this is possible, but with a bit of development at the customer site but it’s not really a hassle, actually, it doesn’t take that much of time because our API really contains everything clearly. So at the moment we only offer re-pricing in such cases, so with integrations.

Kunle: Could you shed some more light on your API, you know, what data points are on offer on your API?

Burc: Well actually, our API is full-featured so it contains any data that we have already throughout Prisynch. And those are basically the price points of any product at any website. So let’s say that your product… you’re tracking 100 products at 20 competitors. So all the prices of those products are fed into our API four times a day at the moment. And also their stock availability, so if a product is in stock or out of stock, we can also monitor that and we can also report that. But another important thing is actually also having access to historical data. Because you know you can compare prices now and you can take actions, but you also need some big picture analysis at the end of the day. For example, for last month’s prices and for example last weekend’s prices, so we also provide historical data throughout Prisynch. And also we have actually an index value, which is kind of an aggregated analysis for particular brands and categories. So the fact here is that you know you can, again, compare your product prices versus your competitors but you also need some signs to see how do you price a particular brand versus your competitors and to do this we have an aggregation model which aggregates prices of particular brands and categories. So we also deliver reports about their brand pricing performance or category pricing performance. So this is also one of the features which really makes Prisych special in the eyes of our clients actually, they can also make further analysis on top of the raw data.

Kunle: I particularly like the historic data, so you have that chart of price movements across-the-board with as many competitors as you wish to follow. I have a question with regards to the historical…does it start the moment we activate it? Or if it’s been in your system, would you provide data prior to the start of the specific campaign?

Burc: Yeah, it’s the second way around. So all the data starts when uploaded actually for the first time in our system, but if we on-board a client and he demands pricing information for particular products that we have been already monitoring we supply them the retrospective data as well.

Kunle: That’s awesome.

Burc: Yeah, it’s also a cool on-boarding surprise because they just on-board, they just want to track a price and that price has been already tracked for the last three months so it’s also a nice little surprise for our clients, actually.

Kunle: Okay, okay. All right. What about email alerts? Do retailers get email alerts for very high priority products?

Burc: Yeah, actually they can get email alerts for any product they like, so they can either assign them as high priority or we can, again, group products in brands and categories. And this actually makes the product quite addictive and this is what we hear from our clients as well. So our notifications become part of their e-commerce day-to-day operations. So they go to the office for example at 9 and they sit down by their desk and at 9:15 we send them their email notifications. And that kind of became how they start their day off. So it’s also quite nice to hear such feedback from our clients, that our notifications are really actionable and they are high prioritized actions, actually.

Kunle: Okay, that makes a lot of sense. Okay, now that we’ve talked about Prisync and the need for price monitoring, could we go into pricing strategy or pricing strategies from your perspective and having viewed hundreds or, you know, several pricing strategies of your customers? In the context of e-commerce for merchandisers of branded products, what pricing strategy actually works? Could you advise or shed more light on how to go about a pricing strategy in e-commerce?

Burc: Sure, actually let me start with an internal saying in Prisynch team. So we always emphasized that optimum price is not necessarily the lowest price. Because at the end of the day we are all trying to build sustainable and profitable companies, no matter what the business field is, for example in our case it’s e-commerce. But we all want to build profitable and sustainable companies. So we also have actually another parameter in the game. Which is the unit cost of the products. So you cannot for example discount your products infinitely because you have a threshold, which is your unit cost. So we always tell our clients to monitor their competitor prices along with unit costs. And to say to them to take actions according to their unit cost as well. So there are actually two types of very, very strategic price moves from the data of Prisynch. So the first case is where you are terribly low, for example you just set a price for a product two months ago but then your competitors increased their prices due to some fluctuation in the market. And then you remained too low. So with Prisynch for example, you can notice that you’re also too cheap. so you can increase your price and actually save a lot of margin by still being the cheapest in the market. So this is the strongest value proposition we deliver to our clients. So it’s not really the expected thing, you know most people expect that we will force them to be the cheapest but mostly we help them to increase their prices in a smart way to make extra margins. So this is quite crucial. And the second is where we are dramatically expensive, so really too expensive. So they can also notice that their prices are not logical at all, so they also decrease them versus competitors, but we always say that they shouldn’t really go away below unit costs. So they should also consider unit costs and they should have a target margin in their minds, let’s say 5%, 10%, or whatever the strategy is. So they should adjust their prices versus competitors’ while always achieving that margin. And thanks to that we actually have an average of 7% profit margin increase achieved all around our clients. So that’s mostly these two strategies I can tell.

Kunle: Wow. Wow, that’s an accolade, that is worthy of praise, 7% across the board. Okay, okay. So the key thing is not to go in a loss, from both strategies you’re not going on a loss. The first strategy really looks at the cost of goods and the second is retaining a target profit margin. And sticking to that discipline. Okay, okay. That makes a lot of sense. Is there any other thing around pricing strategy retailers should not do?

Burc: I think that as I said, being lowest is not sustainable, so that’s what we say. Because whenever we talk to companies they always think that we are the guys who force them to price lowest but that’s not the case, actually. We are the guys who want e-commerce companies to price in a smart way. And that’s the basic difference, actually, so that’s what I can add.

Kunle: Okay, brilliant. I was on your website and I realized Toshiba is a client. Is that at the enterprise? That’s obviously at the enterprise. So you cater for enterprise through to small businesses, is that the case? And how does Toshiba kind of use you know, they own their brand obviously and so that actually contradicts what I said earlier. So how does Toshiba actually use Prisync? How do they typically use it in their instance?

Burc: Yeah. So actually this opens up a new window in our discussion because you know we started as offering competitive price tracking service to only e-commerce companies but then you know obviously this also touches suppliers at the end of the day because e-commerce companies are always in close touch with supplier so they get to know the tools that a company is using, like during just casual chats. So similarly while we were working with some e-commerce companies, they let them know that they are tracking prices of competitors. So for example, Toshiba is one of…

Kunle: Sorry, could we just put this on hold for one second please?

Burc: Sure.

Kunle: Thank you. [ time-lapse ] Hello?

Burc: Hello?

Kunle: Oh, sorry. Please go ahead.

Burc: So I was saying that we actually currently also help suppliers. Because we noticed that they also need to track their own branded product’s online prices to avoid minimum price violations. Because you know those companies have a brand image and brand image also contains the prices of their products. So they mostly want relevant and in parallel prices with their brand positioning. But in online retail you can see very, very deep discounts at a particular retailer at some point. So those companies also want to avoid that by monitoring online prices. So at the moment actually, we are working with suppliers like Toshiba, Nike. Actually, many other companies are also using Prisynch for that particular purpose. So it’s also a different domain that we are entering these days.

Kunle: It’s quite interesting. So they’re using it from a compliance standpoint to monitor retailers, if retailers are actually discounting their products at particular times when they shouldn’t.

Burc: Yeah, and compliance comes also along with competitor tracking because if online retail takes a major percentage of total retail, they also start to feel that they need to track their competitors’ brand even in online retail. For example, Toshiba needs to monitor the average pricing of Lenovo laptops, even in the online retail market. So this is actually a market shaping up I would say, so I think we will see much more interest in the next few months, or let’s say years, from this part of the market as well.

Kunle: Okay, very, very interesting. Okay, I think we have pretty much… Okay, let’s talk about sales. The art of, well, running offers and sales. So from your opinion what would you, as an expert what advice would you give to retailers on the timing of their sales? Obviously there are some unavoidable sales periods like Black Friday, Cyber Monday, Boxing Day here in the UK, and end of season sales or start of season sales. But what tactics or what strategy or philosophy do you have to offer retailers who are looking to sharpen their discounting or strategy?

Burc: Yeah. Actually I think we expect to see that in 2016 let’s say, the e-commerce companies will focus on retention much more than acquisition because acquisition is too costly but retention is way more possible than acquisition, if you really play it smartly. So we noticed that actually at the moment some smart retailers are building up a consistent discount strategy. So they for example have special Saturdays or special Mondays, special I don’t know, Thursdays? But they definitely offer particularly low prices on a group of products, so this makes their already active consumers to consume more from that web shop. So what we will see is, actually, what we expect to see is occurrence of this case much more than the previous years. So particularly, designed discount periods which is kind of blended in parallel with the company strategy. So I think this will be very interesting to track the retention part of the game. We really enforce our companies to have such strategies, for example some of our clients have already started to apply that and they are using email marketing and they are kind of building a brand out of these discount days. And it’s really also receiving social interest, so people are sharing this day in like Twitter or Facebook. So it’s also becoming a funny thing actually, it’s kind of a gamification of sales periods, I would say.

Kunle: Absolutely. And when you put on the layer personalization and then you know your hero customers and you know your laggards and then you’re able to give them the right tune to the frequency, to the right price frequency to get them to to purchase more and more. So retention really is the game.

Burc: Yeah. So actually it’s a little similar to what flash sales kind of took by storm. So flash sales was doing this too often. So what online retailers can do is actually mimicking the excitement of flash sales in a less frequent manner. So they can do this once in every week or once in every month and this can still boost the motivation of shoppers to spend more. So that’s what I mean.

Kunle: That’s brilliant. Brilliant. Okay, let’s go into our evergreen lightning round. I’ll just ask you a question and then you reply with a single answer, an answer in a sentence.

Burc: Okay.

Kunle: So how do you hire people?

Burc: We just sit down with them, have a chat and if we think that they are nice people and smart people and ready for a challenge, we mostly hire them. So the ‘looking for a challenge’ is a must, actually.

Kunle: Looking for a challenge, okay. All right, what are your three indispensable tools for managing Prisync?

Burc: One is, I would say Slack. So we communicate within our team with Slack. And we also do the ticketing through Assembla so it’s one of our to-do list kind of thing, not to-do but ticketing platform I would say. And I think I would also consider LinkedIn as a tool because it’s actually a crucial, crucial part of our marketing strategy. So to sum up: Slack, Assembla and LinkedIn. But these are mostly business development tools, not technical tools.

Kunle: Yes indeed, we met on LinkedIn. Okay, what’s your best mistake to date? By that I mean a setback that’s given you the biggest feedback.

Burc: We started enterprise. So it was actually a mistake because we just started to knock the doors of the big companies from day one and we noticed that they wanted something end-to-end. But then we re-focused on building something kind of more compact, more self-service to tap the small and medium businesses. So it changed the shape of the game actually.

Kunle: Good stuff. What one piece of advice can you give to mid-tier retailers keen to doubling or tripling their business in 2016?

Burc: Focusing on your current customers. So just focus on retention as much as you do for the acquisition. It will really create something.

Kunle: Absolutely. If you could choose a single book or resource that’s made the highest impact on how you view building a business and growth, which would it be?

Burc: It’s Effective Executive, actually. I just recently read that, it’s called Effective Executive from Peter Drucker. It actually speaks about straightforward things in an actionable manner, which is the hardest part actually. You always think of stuff but you don’t really take the action for them. So it makes you take the actions.

Kunle: It starts the action. Okay, finally could you let our audience know how they can finally reach out to you?

Burc: So actually they can just sign up on our website, Prisync.com, or they can just find me on LinkedIn by googling my name, Burc Tanir, and I’m always open for new connections on LinkedIn. Or they can just follow our Twitter profile and all. But the first thing they should do is actually visiting our website, Prisync.com, and signing up and checking out our demo. They are more than welcome.

Kunle: That is brilliant, Burc. It’s been an absolute, absolute pleasure hearing from you on the 2X eCommerce Podcast Show. Price monitoring is so important and you have shed so much light on here. Thank you so much for coming on.

Burc: Thank you so much, Kunle. A pleasure to be with you.

Kunle: All right. So for those of you still here with us sticking to the very end of the show, I hope you found Burc’s insights on price monitoring actionable and very, very insightful, basically. So to download the show notes and to read the full transcripts, head over to 2XeCommerce.com and for updates and tips to grow your store, be sure to sign up for an email alert over on 2XeCommerce.com. Until the next show, do have a really, really good one, everyone. Bye now.