Podcast

Learn from Fast Growing 7-8 Figure Online Retailers and eCommerce Experts

How Best-in-Class eCommerce Businesses Achieve 230% Growth – Tristan Handy of RJ Metrics

About RJ Metrics’ 2015 Ecommerce Growth Benchmark Report

RJ Metrics’ 2015 Ecommerce Growth Benchmark Report prompted this interview with their VP of Marketing – Tristan Handy. As I was curious to understand the fundamental characteristics of fast growing eCommerce businesses – startups and established entities.

RJ Metrics analyzed a combined revenue transaction total of $25 billion from 200+ ecommerce retailers and aimed to answer this single question:

What are the indicators of breakout ecommerce success?

The kinds of eCommerce companies they analysed were:

- Fast growing Internet Retailer IR-500 eCommerce companies

- A majority were venture capital (VC) funded eCommerce start-ups, looking to grow to $10 -100 million and even larger.

- Companies with less than $1 million in annual revenue were also included but they had to be ‘ambitious’ i.e. with plans grow to 10X or $10 million+

‘Best in Class’ eCommerce

By studying the key metrics of best-in-class ecommerce brands (which they referred to as the ‘top quartile’), RJ Metrics was able to gain insights on how growth patterns differ for companies achieving breakout success. Best-in-class ecommerce brands differentiate themselves in one or more four fundamental ways:

- Frictionless commerce – example: Casper.com, solving the inconvenience of mattress shopping

- Build communities and true fans around their brand – example: Bark & Co. has built a strong community around shared interests of dog lovers,

- Use editorial – example: Thrillist with Jackthreads, have reimagined the catalogue and turned it into an editorial experience. Examples of this include

- Using a ‘try before you buy’ experience – Warby Parker’s home try on kits for prescription glasses build returns into the process

Some of the Report’s Insights:

- Companies are getting smarter about growth — those founded in 2013 grew faster than companies founded in earlier years

- By month six in business, top performing companies are generating nearly $450k in monthly revenue

- Top performing companies have an Average Order Value 36% higher than other companies

Go ahead and download the report here.

6 Fundamental Growth Metrics:

Average Growth Rate

- How quickly the business is growing

- Useful to raise external capital

- Key takeaway from report: Revenue alone isn’t an indicator of future performance, but it’s useful in helping us understand what average growth rates look like at different stages of a company lifecycle.

Average Order Value

- Monitor Average Order Value to make sure that you’re not over-relying on discounting.

- Key takeaway from report: Top performing ecommerce companies have an Average Order Value of $94

Customer Lifetime Value

- The best way to measure acquisition marketing

- Ties in with ROI calculations

- Key takeaway from report: Top performing eCommerce companies have a customer lifetime value that is 5 times higher than the next best quartile. On average, a customer at a top performing company is worth $3,600, whereas customers at bottom-performing companies are worth between $460- 770.

Revenue

- Keep track of revenue generated on a monthly basis

- Key takeaway from report: Apparel/Accessories and Houseware/Home Furnishings categories have above average rates of ecommerce penetration, but Food/Drug and Health/ Beauty haven’t had the same success.

Repeat Purchases

- Track purchases made by new customers

- Key takeaway from report: top ecommerce companies are getting customers hooked in their very first months in business.

Customer Loyalty

- How long do customers stay loyal to the business

- Measure customer feedback

- Key takeaway from report: By two years in, about 50% of revenue is from new customers and 50% is from repeat customers.

Jeff Jordan on Layered Growth and ‘Gravity’

It was clear we needed to quickly define a growth agenda that had the scale to fight gravity’s impact. We quickly narrowed the options down to a few: spend more marketing or spend it more efficiently, innovate the product, or buy a company to help us grow.

Factors Driving Faster Growth in Ecommerce

- The increase in technologically- savvy consumers – “Generation Z,” those aged 18 to 24

- Mobile purchasing

- Logistics

- Product and brand differentiation

- Emerging international markets

- Store-based retailers catching up to web-only

About RJ Metrics

RJ Metrics was founded in 2008 by two analysts: Jake Stein and Robert J. Moore from a software-focused venture capital and private equity firm; Insight Venture Partners. They realised that they knew more about the fundamentals of the companies they were running the numbers for than the companies themselves and decided to start up RJ Metrics.

RJ Metrics is an end to end marketing analytics platform and dashboard for businesses (large and small).

They specifically cater for Ecommerce, SaaS and Mobile App businesses.

In ecommerce, they offer vital stats and reporting on Customer Acquisition, Conversions and Retention.

RJ metrics is a company that I have been personally following not only because of what they do but also because of the content that they produce, I’ve subscribed to their blog for well over a year now

and also follow them on LinkedIn.

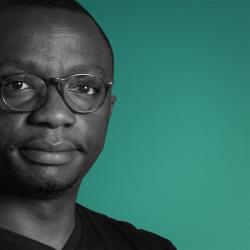

Tristan Handy…

Before becoming the Vice President of Marketing at RJ Metrics, Tristan Handy has been Director of Operations at SquareSpace and a Senior Consultant at Deloitte Consulting.

Tristan shows just how important data and metrics are for companies who need to grow aggressively and successfully by achieving over 230% annual growth, and how he sees the ecommerce space evolving in the coming years.

Key Takeaways

08.02 – An increasing number of our leads are from non-US. I think that that’s reflective of the global ecommerce market.

11.59 – The evolution of ecommerce from being a cheaper alternative to a sector akin to innovative products, power brands and digital savvy founders.

13.42 – What key data points do companies look at to make key decisions.

16.28 – The concept of “best in class”.

21.45 – How companies achieve communities around their brands.

24.24 – 6 fundamental growth metrics.

26.32 – What is Customer Lifetime Value and how to calculate it

32.07 – How size of revenue affects growth.

34.39 – Comparing average metrics with top performers.

37.48 – Mobile ecommerce

39.04 – Which metrics to keep an eye on in 2015

Tweetables

Transcript

Kunle: Have you wondered what growth metrics you need to track if you’re looking for potential investors in your ecommerce venture? Or do you have investors in your ecommerce business and would like to know specific metrics to report to these stakeholders? Well, my guest in this week’s episode reveals what metrics ambitious, fast growth ecommerce businesses must constantly track. He also talks about how best in class top performing ecommerce businesses achieve 230% annual growth or higher. The four core ways these high growth ecommerce businesses separate themselves from the pack and aggressively grow. It is packed with great info to help you start thinking more about growth metrics and grow your ecommerce operations. Take note, because I’ve taken a lot of notes. Listen in, and enjoy the show.

Welcome to the 2x ecommerce podcast show where we interview founders of fast growing seven and eight figure ecommerce businesses and ecommerce experts. They’ll tell their stories, share how they 2x their businesses and inspire you to take action in your own online retail business today. And now here he is, the man in the mix, Kunle Campbell.

Hello 2xers. On today’s show, I have with me the Vice President of Marketing at RJ Metrics. In case you haven’t heard of RJ Metrics, it’s an end-to-end marketing and analytics platform and dashboard for businesses, large and small. They specifically cater for ecommerce SaaS and mobile app businesses. Specifically in ecommerce, they offer vital stats to report on customer acquisition, conversions and retention. RJ Metrics is a company I’ve followed for about a year, just because of the content they produce, I’ve been subscribed to their blog and their LinkedIn company page for a while.

So my guest has been with RJ Metrics for about two years. Prior to RJ Metrics, he worked in the capacity of Director of Operations at SquareSpace, I think it’s a CMS platform, he was also the COO at Argyle Social, and a Senior Consultant at Deloitte Consulting. He also holds an MBA from UNC Chapel Hill. Without further ado, I’d like to welcome to the show Tristan Handy, the Vice President of Marketing at RJ Metrics. Welcome to the show Tristan.

Tristan: Thank you, how’s it going?

Kunle: Very good.

Tristan: I loved your introduction of RJ Metrics. That was the clearest statement of our value prop I think I’ve ever heard. I think I should hire you!

Kunle: I’m flattered! Thank you. Quite a diverse background you’ve been in the industry for, I presume ten years?

Tristan: I’ve been in the SaaS (Software as a Service) space since 2009 and I’ve been following it really closely since 2003. So SquareSpace is one of the biggest online CMS solutions right now, and it was founded by my good friend from high school and college Anthony Casalena in a dorm right across from mine. So SaaS is kind of running in my blood right now.

Kunle: Fantastic. Was it when you had your MBA, or further down?

Tristan: That was undergrad, University of Maryland.

Kunle: Interesting. So you’re Philadelphia based?

Tristan: Yes, RJ Metrics is in Philadelphia.

Kunle: Ok. There are not that many start-ups, am I wrong? I know there’s DuckDuckGo, a search engine company, but what other start-ups are in Philadelphia?

Tristan: There’s a company called Monetate, which does Enterprise level content optimisation and A/B testing. We just had a smaller exit company called SnipSnap, which helps people collect coupons. We’re certainly known in Silicon Valley and we’re not in New York City either. But there’s a vibrant start-up scheme here and we do pretty well from a hiring perspective with all of the local universities.

Kunle: Ok. Is that like a section in Philadelphia where all the start-ups hang out? Is there a Silicon roundabout type? I know in London there is.

Tristan: Yeah, I would say that they’re all over the place. There are some out in the suburbs too because we have some decent mass transit, but there is this one street, North 3rd Street, and if you can picture that in your head it’s almost like the hacker spelling of “Nerd Street”, and for one reason or another, there’s a bunch of companies on that street and the mayor is a big fan of the tech scene and he actually changed some of the street signs to say “Nerd Street”.

Kunle: Symbolism at its best. Symbolism meeting reality. That’s interesting. You wonder if it’s deliberate or not. Ok, so you mentioned Argyle Social, and I’ve been mentioning RJ Metrics, is it one in the same?

Tristan: No, I’m sorry. Argyle was the last company that I was at. We were a social media management tool, kind of like a business class version of HootSuite.

Kunle: Ok, that makes sense. Let’s go into RJ metrics. Could you tell our listeners more about RJ Metrics and what you do for ecommerce companies? A lot of our listeners run or manage ecommerce companies.

Tristan: The company was founded by two guys, Robert Moore and Jake Stein who were analysts at a venture firm called Inside Venture Partners. They were responsible for running the numbers behind these big successful ecommerce companies that Inside would invest in, and they realised that they had a better idea of the underlying fundamentals of these companies, what their customer lifetime values were, what their user cohorts looked like, all of this stuff. They knew more about these companies than the companies did themselves. It was because there was no tool that these companies could use to do this sort of analysis that was so fundamental to a venture capitalist valuing the business. And so they spun out of insight and they developed a tool to allow online businesses to do these types of analytics that were so very important to running the business well.

Kunle: Interesting. When was it founded?

Tristan: I think the company’s docs say 2008. But that was really Bob and Jake in an attic in New Jersey. I think that the first real customers started to come on at the end of 2009. I actually met the two of them in early 2010. When I was at SquareSpace, one of the things I ran was analytics, so I was introduced to those guys through Inside Venture Partners and I used them as a customer.

Kunle: How did you use them while you were at Argyle?

Tristan: This was while I was at SquareSpace, we were raising money back in 2010, and VCs want to see a lot of things, and it was pretty time consuming to get all the numbers together to show VCs a picture of our business that would give them confidence in investing money. We were able to do a lot of that internally, but it took so much time. So I plugged in RJ Metrics and it was amazing.

Kunle: You plugged it into what? Into the systems? Into your accounting system?

Tristan: We connect to a lot of different things, but the core of what we connect to is a database that runs your platform whether that’s an ecommerce or SaaS platform, we connect to that database. That allows us to see all the transactions of all the customers. At SquareSpace, right out of the gate, we were able to get real time counts of how many customers we had, how many new customers we had in the past week, what was user activity like for our various cohorts. We were able to slice all that by acquisition source and all the other things that we needed to do.

Kunle: Interesting. So we’re in 2014 now, about 6-7 years away from start-up. How many clients do you have in the US and off America at the moment?

Tristan: You know, I don’t track the location that well, we’re just surpassing the 400 client mark and definitely the majority of those are in North America, but as the Head of Marketing, I pay close attention to lead flow, and I would definitely say that an increasing number of our leads are from non-US. I think that that’s reflective of the global ecommerce market. I think that US based ecommerce got started earlier than the rest of the world, but the rest of the world is now really growing and catching up.

Kunle: Yes, the UK’s actually ahead on a per-capita basis. It’s quite interesting. Do you have any UK clients that we might know about?

Tristan: We definitely do. I know that our CEO has a big map in his office where he puts a pin for every client. I don’t think I have any that I can say publicly, but I know that the London area on his map has a lot of pins in it.

Kunle: Good stuff. Ok, let’s swiftly move into the reason you’re here on the show is the fact that I came across your 2015 Growth Ecommerce Benchmark report which was published on the 4th of February and it had lots of golden nuggets for me to sink my head in, and as a result, I have a lot of questions for you here. I’m going to start off with, just describe the methodology of the study. For listeners, it’s a growth benchmark report which goes beyond the averages. They dig deep into what makes best in class ecommerce businesses actually grow as fast as they do. So could you just describe the methodology and analysis of the study?

Tristan: I’ll say a couple of different things about it. First of all, this is a study that we do on our anonymised client data. Because we’re an analytics platform, we have this data from hundreds of high growth ecommerce companies and we obviously don’t show any of our clients’ data, but anonymise it so that we can provide some aggregate statistics across that entire population. I think that there’s the question of representativeness, are we studying our clients or are we studying the industry as a whole? I think that there are really two different sections to the ecommerce market. If you go and look at Shopify, Shopify is this ecommerce platform that’s used by, I’m not sure what their customer count is now, but I think they’re above 10000 ecommerce stores, the average Shopify is a little bit on the smaller side, they certainly have bigger companies, but the average is on the smaller side and I would say is not trying to dominate the world, they’re not trying to become the next Fab.com

Kunle: They’re bootstrappers most of the time, aren’t they?

Tristan: Yeah, and there are a lot of people today that are opening ecommerce shops and selling stuff out of their garage or whatever. We’re super excited about that. Those are not the companies that are represented in our report. The types of companies that are in our report are frequently venture funded, they’re frequently trying to grow to be a ten, hundred million dollar and even larger. We work with very small companies, but those are the small companies that are trying to get big. We also work with companies that have gotten big. Some of the fastest growing companies in the [inaudible: 0.11.38] 500 are clients.

Kunle: So core features, they’re VC funded?

Tristan: A lot of them are yes, even the ones that are not, they’re bootstrapping themselves in a way that they’re trying to grow quickly.

Kunle: So they’re ambitious ecommerce businesses?

Tristan: Absolutely yes. If you’re not excited about growing your business, then you don’t need data to do that.

Kunle: I love the start of your report. You mentioned the evolution of ecommerce from being a cheaper alternative to a sector akin to innovative products, power brands and digital savvy founders, which you just alluded to in terms of VC founders. So what part has data played in the success of ecommerce businesses in the last, say 3-5 years in your opinion?

Tristan: Ecommerce is interesting. The first around of this, which is definitely amplified by Amazon is, “let’s just take the experience that you previously had in a store and bring it online and now you can order stuff on your couch. Great”. But, as the market has matured, you’re starting to see ecommerce companies do things that are different. If you look at Birchbox. Birchbox is not an experience that you could have had as a customer 20 years ago. “Send me a box of interesting stuff once a month that you know I’m going to like”. That just wasn’t a thing. So when you’re going to explore completely new ways of delivering experiences to customers, wither you’re going to do it by sheer trial and error and guessing, sometimes that can be ok, but you’re going to have a high failure rate in that case. So what these companies are tending to do is, as they deliver these new ecommerce experiences, they’re using data to see what works and what doesn’t work, and they’re using that to drive, not just their marketing, but their merchandising and operations. Everything about these companies is new and, as a result, they’re using data as much as they can to not run off the rails.

Kunle: Data is broad, so what key data points do these companies look at to make key decisions, or for feedback?

Tristan: I just got off the phone last week with a company called Conscious Box, they’re one of our customers. They haven’t shown up on our website quite yet because we’re still finalising the story, but they’re another solution where you get a box delivered to you in the mail of really cool stuff. They use data to show how happy their customers are with the various products in the box. We connect their systems that show their inventory and what they’re shipping out and, as a result, they’re able to see “We sent these people this stuff and they either were or were not excited about that”.

Kunle: Is there a feedback system to determine happiness from a customer? This is just from Conscious Box’s case.

Tristan: Yes. I can’t speak specifically to how Conscious Box is doing that, but what you find is, if you’re operating online, you have data feeds all over the place that you may not have necessarily been aware of. What a lot of companies do is they correlate different product experiences with return rate or repeat purchase rate so you can look at what people are purchasing and then you can look at whether or not they came back and purchased again. That’s an analysis we do for our clients at the time. So if you like the product you purchase, you probably will purchase again. Those are the kinds of indicators that you can get.

Kunle: That makes a lot of sense. My inclination would be your developers going to the systems with existing databases and create a custom connection to databases of your clients with RJ Metrics, is that the case? Or is it more like a plug-and-play API?

Tristan: It’s definitely more plug-and-play than that. For the database connections, you basically provide your login connections, and at that point, we can kind of drag and drop and say “ok, we want to see these things, we want to analyse this part of the database”. And then you do some data modelling on top of that and eventually end up building charts. We also connect to a bunch of cloud platforms which is really straight forward because everybody’s data looks the same. So customer service platforms like ZenDesk and Desk.com, and a lot of ad platforms. We connect to Facebook Ads and Google AdWords. So that ends up being a lot of the data that we second.

Kunle: Can I ask if you also connect to any analytics or traffic platforms?

Tristan: Yes, we connect to Google Analytics and Mixpanel. People use them a lot.

Kunle: Ok, so let’s go back to the report. I’d like to unpick the concept of “best in class” ecommerce brands. You did mention it at the start of the report, and you said they differentiate themselves in various ways. Could you expand on features or habits of best in class ecommerce brands?

Tristan: Yes, absolutely. We wrote about some of this in the forward the benchmark report, but it wasn’t actually from our research. We called up a guy named Blake Lyon at Lerer Hippeau Ventures. They are one of the premier investors in ecommerce, and he was nice enough to raise a forward based on their experience of investing in ecommerce companies. These are the themes he outlined, he said that best in class ecommerce companies create a near-frictionless buying experience, they make buying really straight forward. They’re really amazing at building passionate communities, they’re really amazing at taking content and commerce, and blend them together. And then offering a “try before you buy” experience, which is not something that, historically, was such a strength of traditional retail. All of those are really combined together into defining these mega brands that are beginning to be part of the ecommerce landscape. It’s those customer experiences that customers love so much, and they end up loving the brands that deliver those experiences to them.

Kunle: If you add all those four: frictionless commerce, communities around their brands, good editorial and content marketing strategy, telling stories really, and try before you buy. Is it one or the other or one of these features?

Tristan: I guess I would say that a lot of these companies are still in their growth phases and so, as somebody who knows what that feels like, you have to do the things that you do best and really dwell down on them. My guess is that you’ll start to see these best in class ecommerce companies do more and more of these things, but the way that they get started is typically, they find one thing that they’re really good at and they go all in on it. The backup for all of this is that they make amazing products, because that is the foundation for any strong ecommerce brand. But if you look at Warby Parker, Warby Parker’s “try before you buy” experience is so strong because it gives you confidence that you’re going to look good in those glasses, and it has ended up as a way of brand advocacy as well. We actually have people bring their Warby Parker glasses “try ‘em” kit to work, and everybody has a fun time with it. They try on all these different glasses and everyone jokes around about it. How much better of an acquisition channel could you get?

Kunle: It’s like going to a showroom, isn’t it?

Tristan: Exactly.

Kunle: So, just to connect to what you said about “best in class”, you mentioned Casper.com and Plated.com, and you said they attributed to not only building long lasting consumer brands, but delivering a near frictionless buying experience. So how do Casper.com and Plated.com create a frictionless buying experience? I just want you to expand on this so listeners can get inspiration from this to see how they can create a frictionless buying experience.

Tristan: Casper sells mattresses.

Kunle: That’s a tough sale, because you need to feel and go on the mattress.

Tristan: Right, exactly. I think, I could be wrong, but to my knowledge, they are the first ones who have tried to sell mattresses online. I have brought, maybe, two mattresses in my life and it’s not been the greatest experience in the world because the mattress store feels like a used car store, the salesman is bugging you while you’re laying down on a mattress. So these guys ship your mattress and they let you try it for 100 days. I can’t believe that that works, but it does and it’s certainly wonderful, as a consumer. That’s the experience that I want.

Kunle: Do you have to pay anything for that?

Tristan: I’m not a customer and I’m not a representative of Casper, but I don’t think that you do.

Kunle: I’ll put a link to the website on the show notes, so the listeners can have a view. And then Plated, how do they do it?

Tristan: Plated is an online experience where you can have meals that are ready to cook, shipped to you. You’ll select some recipes and they’ll ship you all of the ingredients and then you can cook it yourself at home. It’s not so different from grocery shopping, but it’s just different enough that it kind of changes the game. We have always thought of the grocery store experience as, we’re driving that process as the consumer, we’re saying “ok, we think we should buy a little of this, and a little of this”, but it turns out that that requires some creative energy. You have to look at the recipe, you have to be a good cook and Plated is just saying “Look, why don’t you tell us the kinds of foods that you like, we’ll make sure that you have the right stuff and you can just have the fun of putting it together”, and that, as an experience, is so much more fun for me, because I don’t really want to be researching recipes, I don’t really want to make sure that I purchased the herb in the corner of Whole Foods.

Kunle: True, interesting. Let’s move on to building vibrant communities. Two examples you gave were Bark & Co and Chubbies. Amazon controls the “commodities” space, creating communities is the only thing, affinity with customers is the key answer to beating Amazon. So how have these two brands, that you mentioned in your report, actually been able to achieve communities around their brands?

Tristan: Bark & Co is a pretty straight forward example of, you’ve built a company in a space where there is a strong community already. Pet owners love talking about their pets, they love engaging with other people about their pets, and if you go to Bark & Co’s website, you can see that they’ve created a face for this company that kind of plays to that. There’s drawings of dogs at the bottom of the page and it makes you want a dog, it’s the kind of thing that would make you want to interact and let down your guard as a consumer. They don’t feel like some big faceless brand, they feel like people who love dogs. Chubbies is a bit more interesting, I know just a bit more about Chubbies. They are also naturally a little bit of a silly brand and their page shows that as well. They’ve done some cool stuff. Are you familiar with this concept of pop-up shops?

Kunle: Yes, I am.

Tristan: Chubbies has done some experimentation around pop-up shops and I believe that their first pop-up shop had like a barbecue experience built-in. They found out that people in Texas love their shorts, and they were like “We’re going to open a pop-up shop and it’s going to start with a barbecue”. What better pairing of experiences to shorts than Texas barbecues?

Kunle: Interesting. It is much more of a challenge trying to build a community around fashion, I guess, as compared to a passion like pets, or a hobby like fishing and the like. Ok, let’s swiftly move on to the “best in class”. I also realise that flash sale sites tend to have a high growth rate. Two examples that come to mind are TheRealReal.com, they’re a fashion site, and NoMoreRack.com, they’re discounters. They’ve seen well over 250% growth in business in 2013, and you also mentioned them in your report.

Tristan: Yes, No More Rack is a customer and we’re super proud of those guys. They’ve done some really amazing work in the past couple of years.

Kunle: Right, let’s move on to the actual nuts and bolts of the report. Your report is based on 6 fundamental growth metrics. Could you expand on the metrics please?

Tristan: Sure. We are looking at these 6 metrics and we really think that while businesses should look at tons of different things, there’s really no end to the metrics that you could be looking at as a business owner. These are 6 that really all businesses should know about their own business.

First one is Average Growth Rate. How quickly are you growing? That’s important internally, because you probably have goals around growth, but it’s also a factor in your ability to raise external capital. Investors are looking at companies primarily based on growth rate in the early stages.

Second is Average Order Value. There’s not necessarily a right or wrong. Depending on your products, you’re going to charge what makes sense, but what’s really important for you is to make sure that you keep track of average order value trends over time because it’s a way to make sure that you’re not over-relying on discounting or anything like that.

The third one is a biggie. Customer lifetime value. We took some interesting looks at customer lifetime value, we can talk about that in second. As a business, customer lifetime value is the best way for you to measure any of your acquisition marketing because what you really want to do is make sure that you’re investing money in places that return that money and your ROI calculations there need to be based on a sense of customer lifetime value.

Kunle: I’m going to ask a question about customer lifetime value after you’ve finished answering the question.

Tristan: Sure. The next one is revenue. I think that’s pretty straight forward. How much money did you make in a given month?

Repeat Purchases. It’s really important to make sure that you’re tracking purchases made by new customers, so they’re first purchasers versus purchases made by repeat customers, because those have different dynamics and they say completely different things about your business.

The last one is Customer Loyalty. How long are your customers sticking around? How happy are they with your products and your service?

Kunle: Ok, let’s talk about customer lifetime value. Let’s give a use case. I’m a business that has been running for about 24 months now. Say I sell electronics. How accurately can I find out what my customer lifetime value is and what is a lifetime? And how do you factor that into a customer lifetime value?

Tristan: I love that question. I was literally just having this conversation with somebody. I emailed out the benchmark report to 1000 people who had asked for it and one guy responded to me saying “Hey, we have problems measuring customer lifetime value, because they’re still alive so they haven’t died yet, how do I know that they’re not coming back anymore?” In that way, if you have a subscription revenue model, like ConsciousBox, you subscribe to a monthly box that shows up in your mail. You can measure something called Churn Rate and you can extract that data over time and you can get a pretty good idea of how long people are going to stay around and what the average customer lifetime value is. That is a little bit harder for ecommerce companies. You can do some fancy math that does predictive CLV. What we recommend people do when they’re getting started, is just to pick a timeframe. So if you’re doing acquisition marketing, what you are really looking to do is make decisions on what campaigns are working and what campaigns aren’t working so that you can decide where to put your spend. If you are going to try to do that optimisation over the course of two years, that’s just not a fast enough decision process for you to make that optimisation. We tend to recommend, in that case, for people to use 90 day customer lifetime value. That’s a short enough lifetime so you can actually make some optimisation decisions and it works.

The things is, is that criteria better than just looking at your other alternative. The other alternatives are either you look at cost-per-customer, or you look at ROI based on their first purchase. Neither of those is a very good way of doing your marketing optimisation, your 90 day CLV is significantly better.

Kunle: It is. I guess it would be product dependant. If you’re selling furniture, there are only so many times that you’re going to buy a sofa, for instance, as compared to clothing or electronics, or a book.

Tristan: That is completely true. CLV becomes ever more important as your customers buy more frequently from you.

Kunle: Interesting. Ok, so average growth rate. What sectors have seen the fastest growth in ecommerce? I know some people, entrepreneurs will be wanting to find out, because my hunch has been fashion. I sent out a tweet to BigCommerce, because they send out this annual report on growth and everything, but they seem to have missed out the bigger sector, or fastest growing sector. So, from your analysis and your report, what has been the fastest growth rate sector in ecommerce?

Tristan: Did BigCommerce not say anything about…?

Kunle: They said that they were going to come back to me. I was trying to figure out what the biggest sectors are. It was not actually growth, it was more “what are the biggest sectors in ecommerce?”, I was trying to figure that out.

Tristan: We were really interested in answering that question. We came into this report with some hypothesis that we wanted to research and one of the biggest ones of those was “I bet that companies in different sectors grow at a different rate”. Based on our analysis, we found that that wasn’t true. We have this graph in the report, and so our biggest sectors are Health & Beauty, Housewares, Apparel and Food & Drug. If you actually chart those companies’ growth over time, it’s really hard to say that there’s a difference between the way that they grow. I think that that’s actually a wonderful thing. My guess is that there is this bias towards sexiness that shows up in the press, and it’s very easy to talk about a fashion company, it’s relevant to everybody, everybody wants to look like the models that are on their homepage. Those companies are growing quickly, but something like Bark&Co, how many times is TechFresh going to write about Bark&Co? I don’t know, maybe they wrote about them a bunch, but they’re not a company that I see covered a lot. You can find these passionate groups of customers who are looking for a better solution and there’s a lot of room to grow there.

Kunle: I think it goes down into the four features, frictionless commerce, building communities around you, the editorial. I guess it’s down to those four features really, if you can get those fundamentals right, obviously having a fantastic product, and the “try before you buy” is the fourth one. Is that the case in terms of growth? If you get those four fundamentals, in any sector, right then you’ll get to grow rapidly?

Tristan: Yeah, I think that that’s right, and I think that maybe the “try before you buy” experience isn’t relevant everywhere, I was just thinking about what about if you run an online pharmaceuticals? I don’t think you really want a try before you buy experience there, but I do think that those four fundamentals are pretty universal. You can look at those regardless of what segment of the market you are in.

Kunle: The next question has to do with growth rate again. A one million dollar company, or one million pound company, is different to 100 million pound/dollar company. How does size of revenue affect growth?

Tristan: There’s this concept that Jeff Jordan from Andreessen Horowitz, which is a Silicon Valley investment firm, he said some of the smartest things in the industry abut ecommerce, and he calls this concept “gravity”. So if you’re a one million dollar company, it’s not as hard to find 100% growth rate as it is if you’re Apple Computers. At a certain point, when you’re a massive company, it’s really hard to find that incremental dollar. Apple seems to have done it recently, the iPhone 6 is like blowing up. But most companies have a hard time, it’s kind of like the law of nature, as you get bigger, it’s hard to keep up the same pace of growth. What we found is that if you are at a one million dollar revenue line, the best companies are growing at 223%, so if you’re at one million in a year, you need to be above 2. As soon as you get to 2 million and over revenue, you’re growing at 130%, which is significantly less. When you get to 9 million, you’re growing at 100% a year. That is not really a qualitative judgment, that is not to say that smaller companies are better than bigger companies, it’s not about that, it’s just a kind of law of nature that it’s harder to grow as quickly when you get bigger.

Kunle: It ties in with the innovators dilemma concept. When you grow, there’s less room for innovation the bigger you are. Smaller companies seem to be more nimble. There’s just much more growth and space for them to expand if they get the fundamentals right, I guess.

Tristan: Yeah, I would say that’s true. 9 million in annual revenue is a long way from the kind of things where innovator’s dilemma really starts to take over when you’re talking about a company that has been around for 20 years. But you’re right, the underlying concepts are very similar. What we thought about these numbers is that it would help executives set growth targets for their year-to-year growth.

Kunle: So the growth target for a one million dollar company should be 223% and then when they get to about 10 million, you’re more realistically looking at about 100%?

Tristan: Yeah, and that’s average. So if you’re looking to really crush it, then take that and try to do better.

Kunle: Right, good stuff. So what did your report reveal in average lifetime average orders per customer versus average top performers?

Tristan: Most of the report actually looked at companies by core tier of growth. The biggest difference we found was that the population of ecommerce companies, if you look at them in aggregate, there was this nice flat growth line. But if you break them down by core tier, so the best 25%, the next, the next… the best core tier really produced a large majority of the growth, they have really separated themselves from the pack. So once we found out that, the rest of the report was looking at the performance of these top performers versus everybody else. The number of orders that these top companies have got per customer was 7, and compared that to the bottom three core tier, an average of 3 orders per customer. It’s more than double.

Kunle: I guess that ties in to average order value. Did you see a similar trend with average order value?

Tristan: Literally, every one of those metrics I talks about before, the top performing companies were better on every single one of them. For average order value, core tier one, the best companies had a AOV of $94, and the subsequent core tiers were 76,72 and 60.

Kunle: Ok, so how does customer lifetime value play into all the other metrics?

Tristan: If you look at the number of purchases and average order value of those purchases, your customer lifetime value is kind of a multiplication of those two things. When we combine the fact that AOV and number of repeat orders were stronger for the top performing companies, you see that customer lifetime value for these top performers is actually 5X higher than the next core tier. So, the very best companies have a CLV of $3600, and core tier two has a CLV of $770. So it’s really dramatically different. I would just add, I’m just saying this because I think it’s super fascinating, but people listening should download the report because hearing me talk about this is way less interesting than actually looking at the visualisations.

Kunle: That’s exactly what I was going to say! So they just head off to RJ Metrics? I’m going to link to where they can download it, it’s on your website. So just to wrap things up, what do you think the outlook for ecommerce schedule looks like in 2015?

Tristan: Oh gosh. I think that the seeds that we are seeing from some of these early experimenters in the space are really what is going to continue. Delivering the in-store experience, but on your couch, it is going to be completely different shopping experiences. I think that companies are going to increasingly, instead of just products, going to deliver a better experience, in the way that Plated does where you just don’t have to think about what you’re going to buy at the store, they’re going to give you good stuff.

Kunle: This really is omni-channel marketing in a much more established retail industry. Traditional retailers are battling on how to deliver a unified experience from an omni-channel standpoint, and they want to replicate it, not just on the web, but on mobile devices.

Tristan: Yeah, I was just going to say mobile. You could say ecommerce, it’s also very similar to Uber, because it’s kind of humans at a service. I really like Instacart, I started personally using it a month ago, and there have been a couple of bumps in the road. I got white grape fruits instead of red grape fruits, and maybe that’s a little bit annoying, but it’s really wonderful to be able to ask for some groceries and they literally come like 90 minutes later. The whole experience is so mobile focused. When the shoppers hit the store, they call me and they say “hey, we don’t have this, I’ll get you this instead”, and afterwards, to do customer their feedback survey, they send you a text message and you just respond with a 1-5.

Kunle: That’s exciting. We don’t have Instacart yet in the UK. Not yet. Not here in Oxford. Ok, interesting. So what three metrics should ambitious businesses, business owners listening to this podcast, keep a close eye on in 2015?

Tristan: I would say, if I had to pick three, and I don’t like picking three because there are so many, but if I had to pick three, I would say look at the growth in new customers that you’re getting. Is that growing at a healthy clip month over month? Then look at the percentage of your revenue that’s coming from repeat customers, because even though you want to grow your new customers all the time, it’s very expensive to get a new customer and it’s much less expensive to have an existing customer come back for more. You want to make sure that you’re seeing that behaviour happening. You want to see more than 50% of your revenue coming from repeat purchases. The last one is, do you want to be looking at your ROI or your acquisition channels, on a customer lifetime basis? You want to make sure that you are not spending money acquiring customers that don’t pay back.

Kunle: Right. The benchmark you set was 90 days, that can change dependant on the type of business you have in terms of Customer Lifetime Value.

Tristan: Absolutely. It’s based on your specific needs.

Kunle: Without being too “salesy”, how can RJ Metrics help?

Tristan: The funny thing is, this report, because it’s measuring our customer data, anyone listening if you’re ever going to work in a SaaS company, benchmarking is such a great marketing tactic because all of this leads directly to exactly what we help our customers with. If you care about these metrics, these are exactly what we measure for our customers and these are what we help people optimise.

Kunle: Ok, interesting. I’m on your website now and I can’t seem to see pricing, is it intentional?

Tristan: We had pricing up for a while and we’re currently in the middle of changing things up a little bit. I actually am a little bit out of the loop on that, but what I can tell you is that our strategy is specifically to work with companies as they grow, and so we definitely work with start-ups all the time. We don’t want to price anybody out of the game because most of our biggest companies started with us before they made a million dollars.

Kunle: Would they be looking at investing above $1000 a month with you guys?

Tristan: Yes, so if a company that’s at scale comes to us, I think our minimum price today is $1500, but again, we don’t want to turn anyone away.

Kunle: So you’re flexible?

Tristan: For start-ups, on a case-by-case basis, sometimes, yes.

Kunle: Ok Tristan. Really great to have you on the show. I’m going to round up by asking you what books and resources about growth you’d recommend to listeners and retailers?

Tristan: I would actually point people to Lean Startup. Maybe that’s over-hyped and everybody talks about that, but The Lean Startup is the kind of book that I read every year, because it really informs the entire culture of our business. It shows you how to run a business focused on learning new things, and that’s really what all of us who are growing companies need to be focused on learning as an output as opposed to just revenue.

Kunle: That’s a really good one. So you read it every year. It’s all about learning and cycles. Ok, that’s really good advice. Finally, how can our audience reach you or get in touch if they wanted to find out more about RJ Metrics or just connect with you?

Tristan: Our website is predictably RJMetrics.com and you can find us on Twitter @RJMetrics. I would love to hear from anyone who happens to listens to this, my Twitter is @JTHandy.

Kunle: Good. I’ll also have a link to your Twitter handle on the show. Thank you so much Tristan, it’s been a pleasure having you on the show.

Tristan: I’ve had a great time, thanks so much.

Kunle: Good stuff. See you.

Tristan: Alright, have a good one.

Kunle: Bye.